With warehouse product lead times extended to 2025 and beyond, pipelining has been a strategy employed by some dealers to win new conquest business. Pipelining decreases lead times and price becomes less of an issue to the customer.

Dealers frequently cite risk as their biggest aversion to pipelining or acquiring build slots. For two dealers, Shoppa’s Material Handling and The Lilly Company, the rewards of pipelining far outweigh the risks. Their calculated gambles are paying large dividends and winning new customers.

Jason Bane, VP of Sales at The Lilly Company, stated, “There are always risks with having high levels of inventory, especially with rates being as high as they are and the markets making a downward shift. However, we haven’t been hounded with inventory that we haven’t been able to move and the reward has far outweighed the risk.” Lilly recently ousted a long-term incumbent at a distributor of medical equipment and supply company to win a 35-truck deal of order pickers, end-rider pallet jacks, and reach trucks. They obtained the sale because they had shorter lead times than their competition. Lilly won new Dealer National Account business, both LDNA and NPP, due to shorter lead times and earlier availability.

Shoppa’s Material Handling is developing a scientific method of pipelining warehouse products to maximize Class 2 and 3 market share. Kevin Pate, Director of Fleet and Heavy Duty, looks at several key data points when making decisions by utilizing the TMH Power BI tool:

- Quoting Activity

- Sales History- ITA

- Understanding the market and buy cycles of large customers

- Employing a growth strategy where the percentage goals for each class are established

Shoppa’s pipelines Reach Trucks with mast heights of 270”, 301”, and 400”, Order Pickers, Stand-Up Counterbalance, End-rider jacks, both double and single length, and Center Rider Pallet jacks. They carefully select models specific to industries and customers and spec change to meet the customer’s requirements. Shoppa’s has conquered many new customers in the warehouse product space including the newly minted LDNA- Mission Foods. Alex Rodriguez, Major Accounts Representative, blended excellent sales tenacity and a robust pipeline of warehouse products to unseat Crown for over 100 units in 2023.

To date, Shoppa’s Class 2 market share is three times the national average. Kevin Pate advised, “If we don’t have a build slot, we can’t sell it with a two-year backlog” and discussed risk by adding, “There’s risk to NOT pipelining”. In cases where Shoppa’s doesn’t sell their pipelined units, other dealers and National Accounts invariably will pick up their slack.

Engage your District Sales Manager and discuss opportunities to create more market share by owning more build slots.

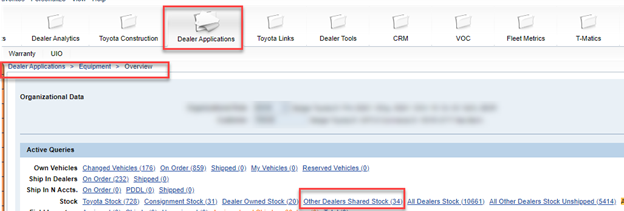

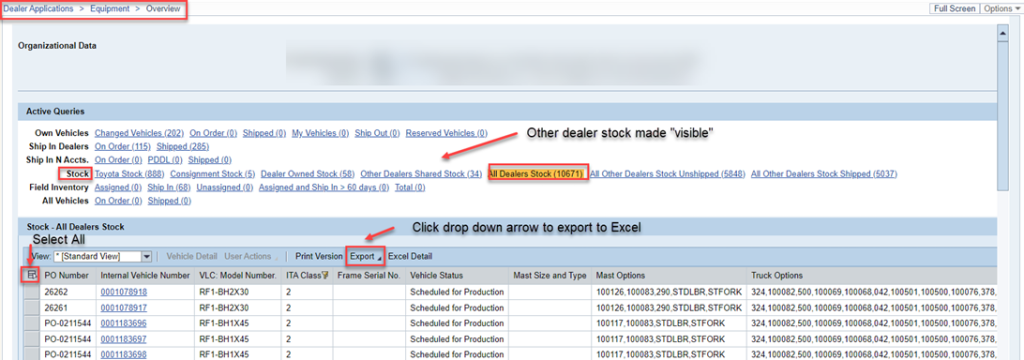

Dealer Stock/Pipeline Visibility on the Portal:

Follow the path below to view and download dealer stock/pipeline on the Portal. The list of units can be downloaded and filtered by model including configuration and production dates. Contact the owning dealer for availability.

Units That Are Available for Release or Trade:

A best practice would be for dealers to mark any units they are willing to release/trade as “visible. This will save the dealers time on contacting the owners of pipelined stock.

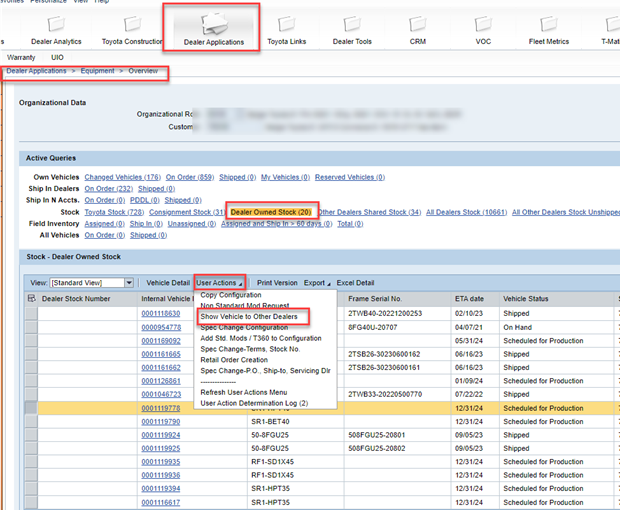

How to Mark Units “Visible” in the Portal:

Follow the path below to select your dealership’s stock units. Click on “Unit” and then on “User Actions.” Select “Show Vehicles to Other Dealers” to make units visible. The units will then be listed in the “Other Dealer Shared Stock Tab”.

Other Dealer Shared Stock Tab